QuickBooks Desktop for Non-Income

It’s no secret that tens of millions of small enterprise house owners throughout the globe use Intuit purposes resembling QuickBooks Desktop or QuickBooks On-line to handle their funds. With its minimal studying curve, good reporting choices, and the selection of both a desktop or on-line software, QuickBooks generally is a actual asset for almost any kind of enterprise.

However what about nonprofit organizations? Are QuickBooks purposes a good selection for them as nicely?

That’s a troublesome query to reply. For smaller nonprofits, each QuickBooks Desktop and QuickBooks On-line can present good monetary administration choices. Nevertheless, for bigger nonprofits that handle a number of funds, applications, or tasks, or obtain grant funding, there are nonprofit accounting software program choices out there that provide true fund accounting, which can be a greater match.

Why nonprofit software program is completely different

Like several enterprise, a nonprofit must carry out commonplace bookkeeping duties resembling dealing with a number of financial institution accounts and financial institution reconciliations, monitoring organizational bills, and paying distributors on a well timed foundation. However nonprofits additionally must deposit donations and grant funds, monitor each financial and in-kind donations, present donors with tax receipts and thanks letters, and in lots of instances handle volunteers.

Listed below are only a few of the ways in which for-profit and nonprofit organizations differ.

- Taxes – Whereas for-profit companies are required to pay taxes on their earnings, a nonprofit group is exempt from paying taxes on donations or grants. Nevertheless, like a for-profit enterprise, a nonprofit remains to be answerable for all federal, state, and native taxes, in addition to Social Safety and Medicare taxes.

- Revenue administration – A for-profit enterprise can put income earned into retained earnings for future use, distribute earnings to shareholders, or a mix of the 2. Any revenue earned by a non-profit should be reinvested again into the group’s work.

- Accountability – Whereas a for-profit enterprise is usually accountable to the house owners or shareholders, a nonprofit is accountable to its board members in addition to anybody that gives funding to the group, whether or not it’s a $5 million grant or a $50 donation.

As well as, nonprofits typically maintain fundraisers or run campaigns to be able to fund their applications. The entire funds raised from that fundraiser or marketing campaign, in addition to any associated bills, have to be dealt with individually, utilizing separate funds.

Like for-profit companies, nonprofits fluctuate in each measurement and scope. For instance, a company that sometimes is funded solely via grants can have a lot completely different accounting wants than that of a company that’s funded via public donations.

The next are only a few of the areas that nonprofit organizations must handle.

- Chart of accounts: Some of the essential elements in nonprofit software program is the power to create a customized chart of accounts. In the event you solely handle a couple of applications or tasks, it is a easy factor to do in any accounting software program software. Nevertheless, when you’re not utilizing an software with a versatile chart of accounts, you’ll must create quite a few sub-accounts, making the complete course of much more complicated.

- Donations: In case your nonprofit is funded primarily via particular person donations, you have to a solution to handle each the donation in addition to every donor. You’ll additionally want to offer donors with thanks letters and receipts.

- Grants: Many nonprofit organizations are funded by grants from varied state and native authorities entities, or via non-public foundations. In the event you obtain grants from greater than two entities, it’s clever to have a solution to handle every grant individually.

- Funds: Fund administration is a catchall class for foundations that obtain funding from a number of sources. In the event you obtain funding from a number of sources, you’ll must have a solution to individually monitor exercise for every of these sources.

- Campaigns: In the event you sometimes have quite a few campaigns all year long, you’ll want a solution to monitor each earnings and bills for every marketing campaign.

Select nonprofit software program that fits your group

For smaller nonprofits, utilizing QuickBooks Desktop or QuickBooks On-line is satisfactory. For bigger nonprofits that wish to proceed utilizing QuickBooks purposes, your finest wager is to make use of the nonprofit version of QuickBooks, which is accessible in each QuickBooks Premier and QuickBooks Enterprise editions.

These are a couple of of the nonprofit options discovered within the QuickBooks Nonprofit version.

Nonprofits want accounting software program to deposit donations and grant funds, monitor each financial and in-kind donations, present donors with tax receipts and thanks letters, and in lots of instances handle volunteers.

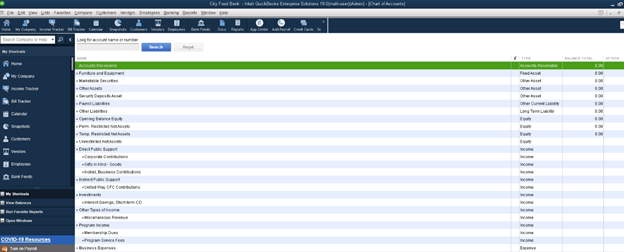

Create a nonprofit chart of accounts

To correctly handle a number of funds, you’ll must have entry to a nonprofit chart of accounts. In contrast to the usual model of QuickBooks, QuickBooks Enterprise for Nonprofit Organizations features a default nonprofit-specific chart of accounts that may be simply personalized to fit your wants.

QuickBooks Enterprise chart of accounts gives flexibility for nonprofit organizations.

The default chart of accounts additionally incorporates the unified chart of accounts, making it simple to switch monetary knowledge immediately into IRS types for simple processing and submitting.

Getting into transactions

As soon as your chart of accounts has been arrange correctly, you may start to enter accounting transactions.

QuickBooks Enterprise for Nonprofits lets you benefit from useful options resembling digital invoicing, which permits your donors or clients to pay on-line utilizing a hyperlink that’s included within the bill. Computerized reminders could be set as much as remind donors and clients about upcoming fee due dates.

It’s also possible to create e-mail receipts for donors and clients instantly upon receiving their fee, which may also be emailed to them for added comfort.

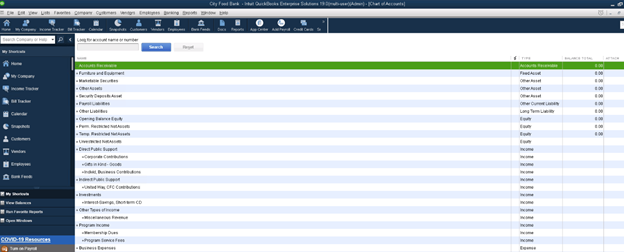

Together with processing funds and invoicing, you may monitor mileage and schedule duties and appointments. As well as, QuickBooks Enterprise simply integrates with Microsoft Workplace and contains a number of paperwork constructed utilizing Phrase templates, making it simple to offer donors and supporters with every little thing from a receipt for a donation, to an annual attraction letter.

QuickBooks Enterprise gives letter templates to simplify the letter preparation course of.

As well as, Enterprise additionally gives integration with Salesforce CRM, enabling you to handle your donor database with out the necessity for duplicate knowledge entry.

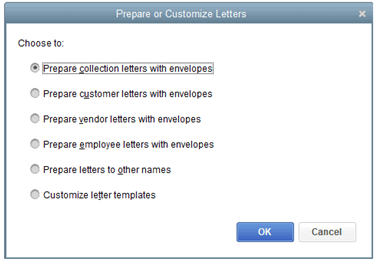

A straightforward-to-use interface

In the event you’re already aware of QuickBooks Desktop purposes, the nonprofit version gives the identical person interface, that provides easy accessibility to all duties from the workflow space.

QuickBooks Desktop contains an simply navigated person interface.

In the event you desire, you may entry all system duties from the vertical menu on the left aspect of the display. Additionally included are a sequence of job icons on the menu bar on the prime of the display.

As well as, you may create a ‘Favorites’ checklist on the vertical menu bar that lets you rapidly entry steadily used duties.

Reporting

Each for-profit and nonprofit companies want entry to monetary statements together with different enterprise and monetary stories. Nevertheless, a nonprofit group additionally has to current board members with a wide range of nonprofit-specific stories which embrace the next:

- Assertion of economic place: Just like a normal steadiness sheet, the assertion of economic place shows property, liabilities, and internet property whereas offering detailed data on restricted, quickly restricted, and unrestricted property. On the assertion of economic place, internet property take the place of proprietor’s fairness, since a nonprofit doesn’t have house owners or traders.

- Assertion of actions: The assertion of actions is a worthwhile report for any nonprofit, exhibiting any modifications in internet property over a particular time frame. The assertion of actions is just like an earnings assertion, but in addition contains each present and prior-year totals, budgeted totals, and finances variances for a specific time frame. As well as, when making ready an announcement of actions, an in depth clarification of any modifications which have occurred throughout that time frame ought to all the time accompany the assertion.

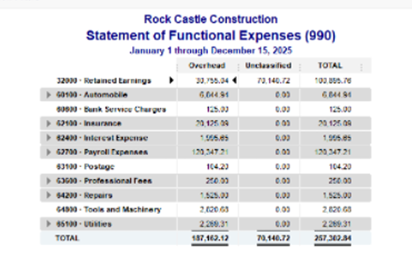

- Assertion of useful bills: The assertion of useful bills gives particulars on administrative and overhead bills, in addition to fundraising bills for every program administered by the nonprofit. This report can be used when making ready Type 990 for the IRS.

- Money movement assertion: The money movement assertion is the one report that’s utilized in each for-profit companies and nonprofit organizations. The money movement assertion identifies and stories on money acquired from working and funding actions in addition to money from financing actions.

All of those stories are supplied in QuickBooks Enterprise for Nonprofits, together with different nonprofit stories which embrace:

- Donor Report

- Grant Report

- Donor Contribution Abstract

- Funds vs. Precise by Donor

- Funds vs. Precise by Grants

- Largest Donors

- Largest Grants

Like all QuickBooks Desktop stories, the nonprofit stories could be seen on-screen, printed, or emailed on to recipients. This selection can come in useful when making ready board stories for upcoming conferences or to simply preserve members within the loop.

Type 990

Regardless that nonprofit organizations are exempt from taxes, they’re nonetheless required to file a tax return at year-end.

That tax return, Type 990 can be made out there for public inspection and can have to be filed yearly to retain nonprofit standing. Although many nonprofits have their accountant or CPA put together Type 990, having good accounting software program in place that may adequately handle nonprofit funds is a should.

The Assertion of Useful Bills is used when making ready Type 990 for the IRS.

Budgets

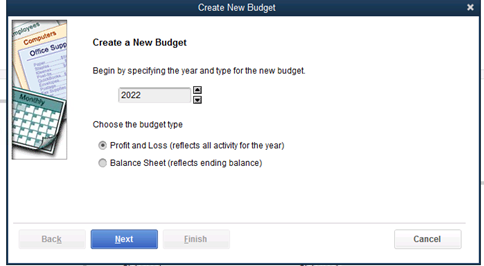

Correct budgeting is essential for any enterprise, however maybe much more essential for nonprofits. In QuickBooks Enterprise for Nonprofits, you may create an annual finances from scratch, or use prior 12 months numbers as a very good reference level. It’s also possible to import a finances from one other supply if desired.

As soon as a finances has been created you may simply use included stories such because the Funds vs. Precise to trace precise bills towards these budgeted.

To create a brand new finances, simply click on on the Set Up Budgets choice which is positioned underneath Nonprofit on the primary menu. You’ll be able to create a finances on your complete group or particular person accounts or courses.

The Create a New Funds characteristic permits you to select your most well-liked finances kind.

You’ll be able to select from both a Revenue and Loss Funds format or a Stability Sheet format on your nonprofit. When you select a format, you’ll additionally have the ability to select any further standards you want to embrace within the finances, together with Buyer Job or Class.

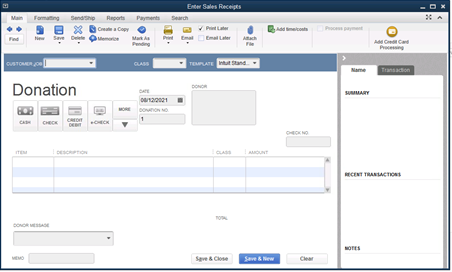

Donations

In case your nonprofit is funded primarily by donations, you’ll want to have the ability to handle these donations correctly. The Enter Donations characteristic does simply that. This characteristic is mainly the identical because the Enter Gross sales Receipts characteristic in common QuickBooks editions however has been revised to incorporate nonprofit-specific language.

The Donation display lets you enter all the data you want for any donation.

The donation display is the place you may enter the donation quantity, description, and the way the donation was paid. In the event you’re signed up for QuickBooks Funds, you too can course of donor funds made by bank card immediately from this display as nicely.

For monitoring functions, you’re additionally capable of connect any associated recordsdata to the donation. You’ll additionally have the ability to e-mail a receipt on to your donor, with an choice so as to add a private message immediately from the donation display as nicely.

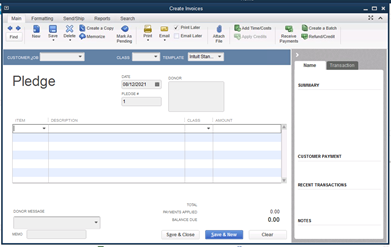

Enter Pledges

In case your nonprofit usually accepts pledges from donors or constituents, you may simply bill the pledge quantity from the Pledges/Bill display. This is similar display used to create invoices within the desktop model of QuickBooks, with wording up to date to raised swimsuit the wants of a nonprofit group.

The Pledge display is the place you may course of pledges (invoices) for any pledges made.

To enter a pledge, simply enter the merchandise quantity assigned to the pledge together with an outline. Once more, you may add a customized message to the pledge bill if desired.

QuickBooks Desktop Enterprise for Nonprofits vs. QuickBooks On-line

In the event you’re within the course of of selecting between QuickBooks Nonprofit or QuickBooks On-line, there are some benefits to going with the desktop model. Whereas QuickBooks On-line gives the good thing about any time/wherever entry so long as you’ve gotten an web connection, it would require extra customization to be of profit to nonprofits. In the event you do go for the on-line model of QuickBooks, utilizing add-ons can provide you a extra full accounting resolution. Although some further customization is accessible in QuickBooks On-line Superior, the on-line model remains to be higher suited to for-profit companies.

Alternatively, QuickBooks Desktop’s non-profit model gives quite a few nonprofit-specific options. If pricing shouldn’t be a priority, forego QuickBooks Professional and go for the costlier QuickBooks Premier or QuickBooks Enterprise.

,