The economic system of the nation shrank by 0.7% within the first quarter of 2020. After which the GDP numbers for the second quarter present that we skilled a large 16.5% contraction.

When the economic system shrinks for 2 consecutive quarters, it’s referred to as a recession. And thus, the Philippines is now formally in a recession.

And in case you’re questioning, the final time we underwent a recession was in 1991. A string of pure disasters, the facility disaster, and political unrest led the nation to that financial occasion.

For these anxious about their private finance, then learn my earlier article entitled: What To Do Throughout a Recession to Defend Your Cash

Right this moment, we’ll be discussing the distinction between a recession and a melancholy. And in addition be taught a bit concerning the financial or enterprise cycle.

Recession vs Melancholy: What’s the distinction?

Economists differ of their definition of a recession, however the one given above is probably the most extensively accepted — when the economic system shrinks for 2 consecutive quarters.

In the meantime, financial melancholy has no normal definition. In a number of macroeconomic books that I’ve learn, an economic system undergoes a melancholy if there are repeated intervals of GDP contraction.

Then again, I keep in mind my Economics professor telling the category that when the GDP shrinks and the destructive results are delicate, then it’s a recession; but when the results are extreme, then it’s a melancholy.

Personally, my favourite definition of the distinction between the 2 comes from US President Harry Truman. He says, “It’s a recession when your neighbor loses his job; it’s a melancholy if you lose yours.”

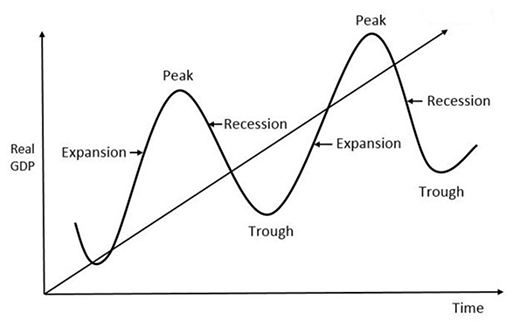

Financial/Enterprise Cycle

The enterprise cycle, or what others name the financial cycle or commerce cycle, refers back to the downward and upward motion of the GDP development fee over a few years.

There are totally different fashions and classifications to explain the enterprise cycle. However maybe, the preferred is the one proven beneath.

Phases of a Enterprise Cycle

Increase/Peak

The interval when the GDP rises larger than its earlier long-term pattern.

Slowdown

The other of Increase, which is the interval marked by a lower within the GDP.

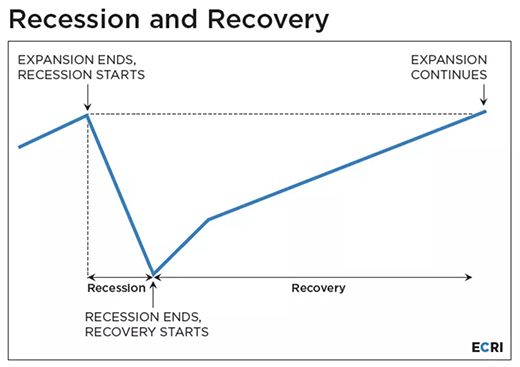

Recession

A interval of decline within the GDP, usually for 2 consecutive quarters.

Melancholy/Trough

A protracted interval of financial downturn with extreme results on the economic system.

Restoration/Enlargement

The GDP begins to constantly enhance following a recession or melancholy.

Picture: Financial Cycle Analysis Institute

Picture: Financial Cycle Analysis Institute

Why is it vital to know these?

Understanding these financial phrases may also help you in making enterprise and funding choices. You possibly can regulate your monetary methods to benefit from financial booms and handle dangers throughout slowdowns.

For instance, it’s greatest to be conservative in your investing choices during times of recession, specializing in low-risk and income-generating belongings. In the meantime, restoration intervals sign alternatives to shift in direction of higher-risk investments.

As all the time, private finance is private, and monetary choices ought to match your assets, threat tolerance, and monetary targets.

However understanding and understanding what’s taking place to the financial sea offers you a bonus to higher navigate the waters.

So, it’s possible you’ll now be asking… what do you have to do when an financial melancholy occurs? I’ll write about this in a future article. However for now, it’s greatest to be good and prudent along with your private finance.

Additional Studying: What To Do Throughout a Recession to Defend Your Cash

What to do subsequent: Click on right here to subscribe to our FREE e-newsletter.

Share Tweet